Mortgage Blog

Let's Build a Strategy - Inflation, Rates, and the Housing Market

September 27, 2022 | Posted by: Sharon Patton

Let’s Build a Strategy – Inflation, Rates, and the Housing Market

Inflation is still high, we have seen another rate increase and the housing market is changing. All of this may have you concerned and feeling overwhelmed. It is very easy to be reactive in these uncertain times. Let's be proactive and look at some facts!

What is Inflation?

Inflation is a rise in prices, which can be translated as the decline of purchasing power over time. The loss of purchasing power impacts the cost of living for everyone which leads to a deceleration in economic growth. To combat inflation, generally, the Bank of Canada increases the overnight lending rate, which in turn increases the Prime lending rate. This generally helps to manage the money supply and credit to lower inflation and keep the economy running smoothly.

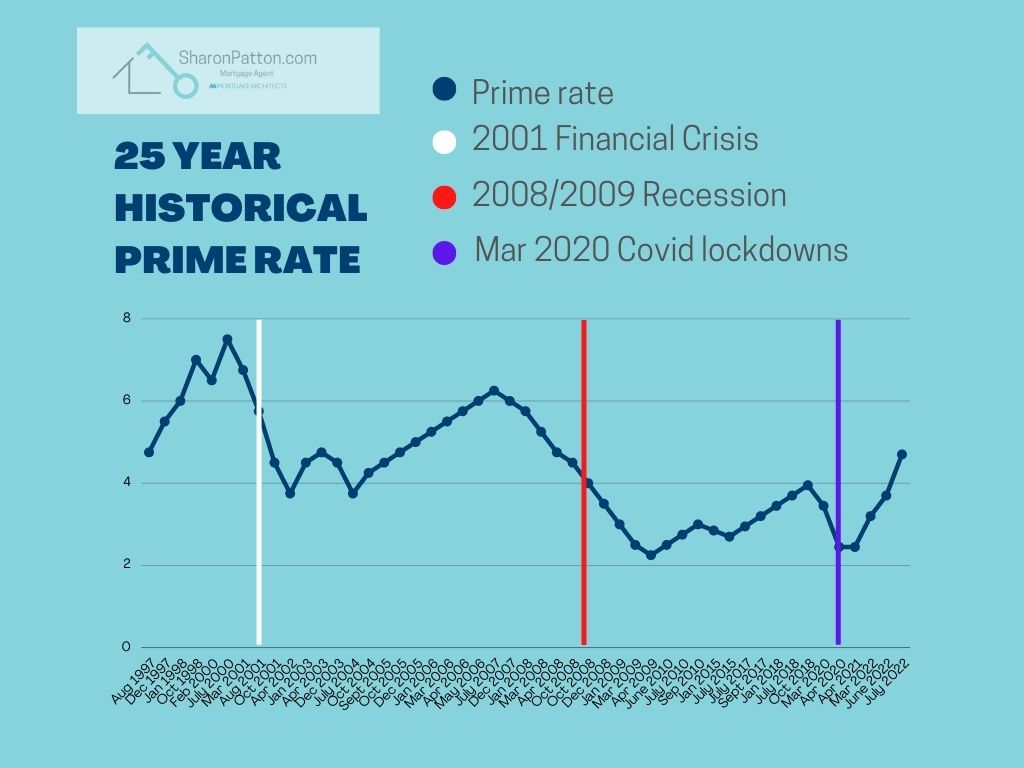

It may seem all doom and gloom when it comes to rates right now. Let's take a closer look at the 25 year historical life of Prime rate. In times of financial crisis, we see a drop in the Prime Rate. This is done so that people will spend by taking advantage of lower interest rates on credit. Which will make the economy start to flourish again. When faced with rising inflation today, the Bank of Canada is increasing interest rates to slow the spending rate and relieve the supply chain. If we look at the graph below we see the following:

- Rates are cyclical

- Higher rates do not last forever

Purchasing – Peek March 2022 vs Today

Even though interest rates have increased this is still a good time to purchase. Let's look at the numbers. If housing prices have come down 26% since the peak in March of this year, there is a nominal difference in monthly carrying costs, even with a rate 2.25% higher. If you bought in the peak at $1,700,000 the monthly payment is $5,900 vs if you buy today at approx. $1,250,000 which has a monthly payment of $5,640 at today's rates. The bonus - your down payment is lower. (*based on 20% down payment)

Buying vs. Renting

With escalating rental increases let's review buying vs renting. If the average 3 bedroom freehold townhouse currently rents for $3,250 and sells for $900,000. On the purchase, the monthly mortgage and property taxes are $4,265, but $835 of that is going to principal repayment, netting out at $3,430. At the end of 5 years, you will have accumulated an additional $57,000 in equity plus any market appreciation. With the buying option, you would need to have $180,000 for a down payment. Even with rate increases, it is not less expensive to sell and rent in this market.

Do You Have a Budget in Place?

Now more than ever it is important to have one to track your expenses. You can see where you can save money and also address any cash flow issues. Even though mortgage rates have increased they are still 10 to 15 percent lower than credit card interest rates, so it may be worth exploring consolidating those debts. We can offer you a few solutions that will allow you to free up some cash, or even have an emergency fund ready for those unexpected expenses that arise.

If you are looking to purchase, refinance, or if your mortgage is coming up for renewal, let's chat. We are here to build a strategy that works for you.

I look forward to connecting with you soon.

Follow us on Facebook and Instagram for more mortgage tips.