Mortgage Blog

Increased Expenses and Decreasing Cashflow - We Have Solutions

March 31, 2023 | Posted by: Sharon Patton

Have you noticed with inflation that your monthly expenses have increased and your cashflow has decreased?We have solutions.

Let's explore these below.

Mortgage Renewal

Is your mortgage coming up for renewal in the next 6 months?

Worried about your monthly payments increasing with changes to your rate?

Did you know that we can lock in a rate 120 days before your mortgage term expires. This will protect you from the risk of higher rates on your maturity date. If rates decrease in those 120 days then we can lower your rate before closing.

Let’s chat about protecting your interest rate.

Refinancing and Debt consolidation

With the cost of everything on the rise, it is easy to see your monthly cash flow decreasing. You are holding one of the biggest investments in your home.

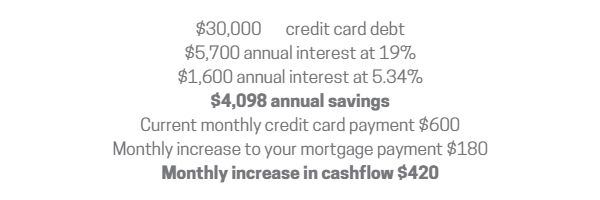

We can look at what equity you have built up in your home and explore the option of refinancing your mortgage. We can even look at rolling in some high-interest loans and credit cards to reduce your amount of interest being paid out and increase your monthly cash flow. Let us show you how:

Planning for the unexpected

We are all about planning, but sometimes life throws something unexpected at you.

Wouldn't it be great to have access to an emergency fund for these times?

We can help you with this by looking at the option of adding a line of credit to your existing mortgage product.

Let's chat and see what your current mortgage offers you and explore other options available to you too!

Follow us on Instagram and Facebook for more mortgage tips and advice.

Looking forward to connecting with you soon.

Your Mortgage Partner for Life