Mortgage Blog

Understanding Reverse Mortgages - Securing Your Financial Future

October 2, 2023 | Posted by: Sharon Patton

A reverse mortgage has become increasingly popular for thousands of Canadians 55 or older to secure financial peace of mind. This is done by putting your home equity to work for you.

Let's take a closer look at understanding how a reverse mortgage works, who qualifies, and how it can benefit you or a loved one.

In Canada, a reverse mortgage is a type of loan that is secured against a homeowner’s principal residence. While it bears some similarities to a regular amortizing balance mortgage, there are a few key differences, namely:

Applicants must be 55 years of age or older

Applicants must own their house/residence

No monthly payments required

Interest accrues on outstanding principal and interest

Ways You Can Use A Reverse Mortgage:

Increase cash flow

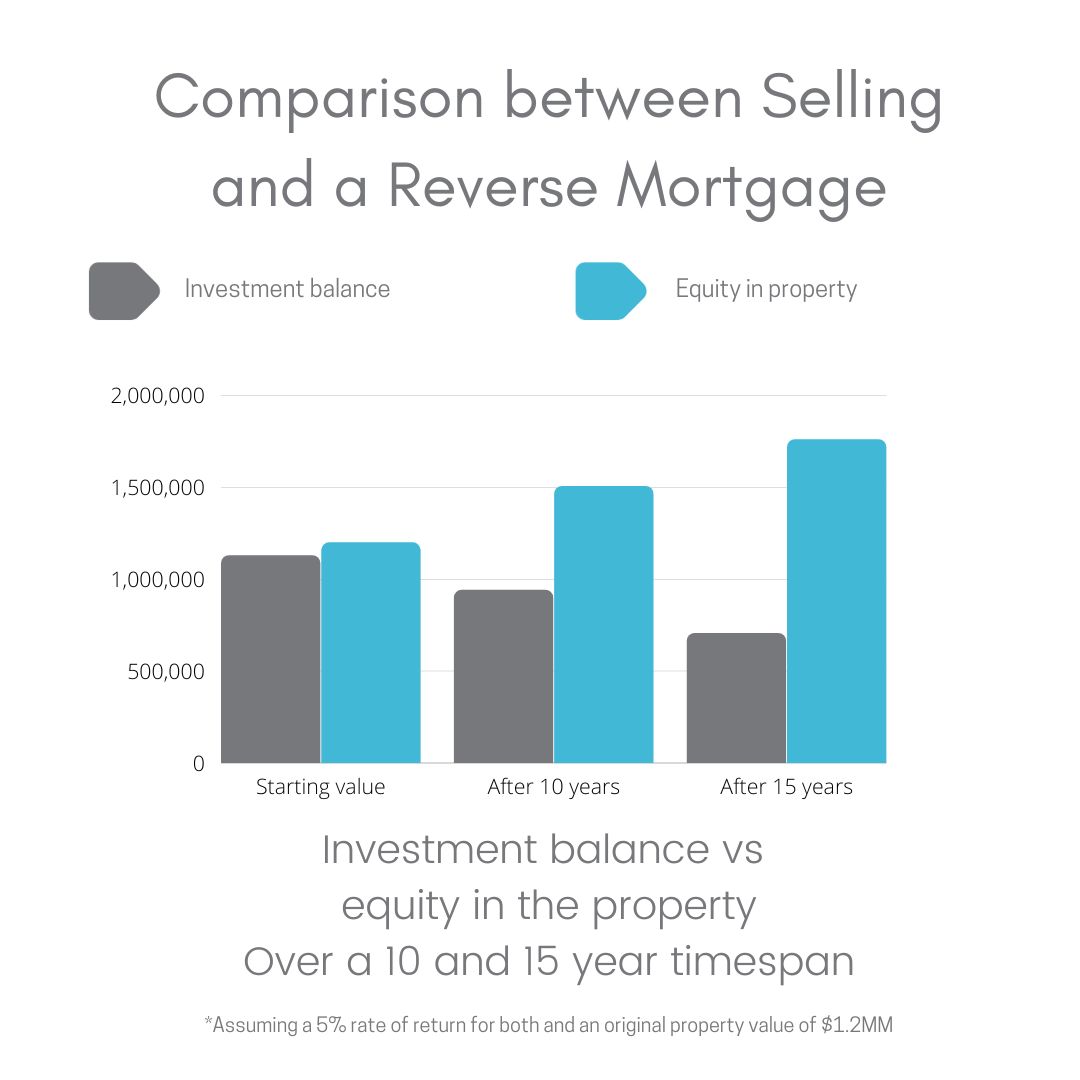

Preserve investments

Relieve financial pressure

Alleviate debt

Healthcare expenses

Home renovations / improvements

Travel

Assist a family member

Early inheritance

Buy a vacation property

To look at your specific scenario, please contact us!

Here are some benefits of a reverse mortgage:

Accessing tax-free funds

No monthly payments required

Still benefit from property appreciation

Flexible use of funds

Supplement retirement income

Maintaining a lower income tax bracket and preserving investments

Housing stability

If a reverse mortgage sounds like a solution for you or a loved one, let's chat today and explore the benefits and options.

Follow us on Facebook and Instagram for more mortgage tips and advice!