Mortgage Blog

Achieving Financial Freedom

October 16, 2023 | Posted by: Sharon Patton

Did you know that we have access to the Manulife One product?

What is the Manulife One Product?

It is a revolutionary way to manage your money.

How does it work?

Manulife One is an all-in-one home equity product that combines your mortgage, debts, bank accounts, and short-term savings to reduce interest costs and become debt-free sooner.

With Manulife One every dollar you deposit from your income or savings immediately reduces your debt. Repaying your highest debt from your Manulife One account will reduce your interest costs.

Let's take a closer look at the benefits.

Customize Your Mortgage

With sub-accounts, you can lock in a portion of your Manulife One account at a fixed interest rate.

Simplify Your Everyday Banking

Manulife One makes your banking easier by bringing all of your accounts together – you only have one account to manage with one monthly statement.

Be Prepared for a Rainy Day

Manulife One lets you be prepared for the unexpected by giving you access to your money when you need it. You can always access your money and home equity – up to your borrowing limit.

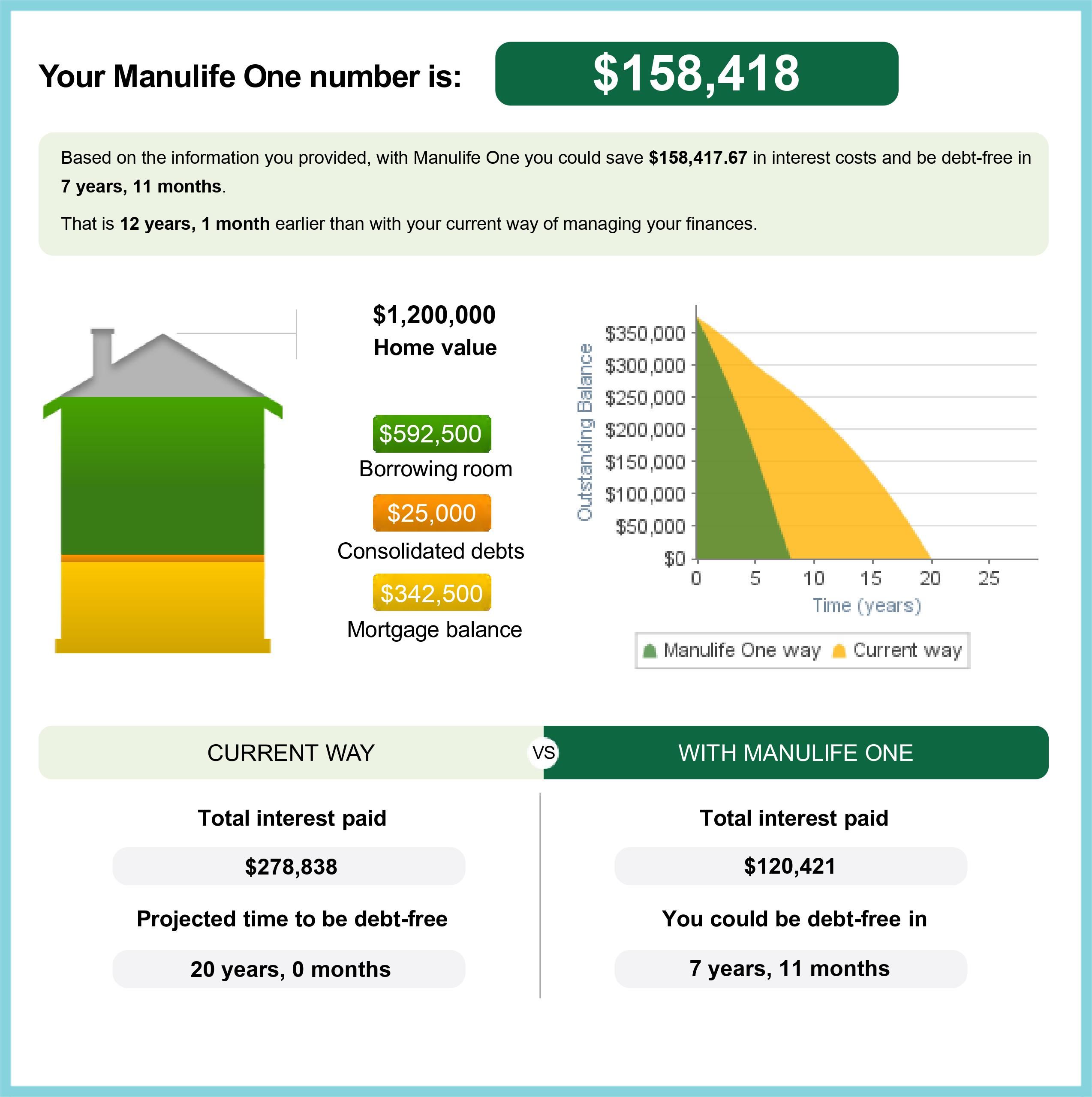

Save Thousands in Interest

With Manulife One every dollar you deposit from your income or savings immediately reduces your debt. Consolidating high-interest rate debt to your Manulife One account will help reduce your interest costs.

Become Debt-free Years Sooner

By depositing your short-term savings and income to your Manulife One, you reduce your loan balance and lower your borrowing cost. All your money is working for you as hard as it can - every single day.

**Based on a home valued at 1.2 million dollars, let's take a look at the numbers and how the Manulife one works to achieve financial freedom sooner**

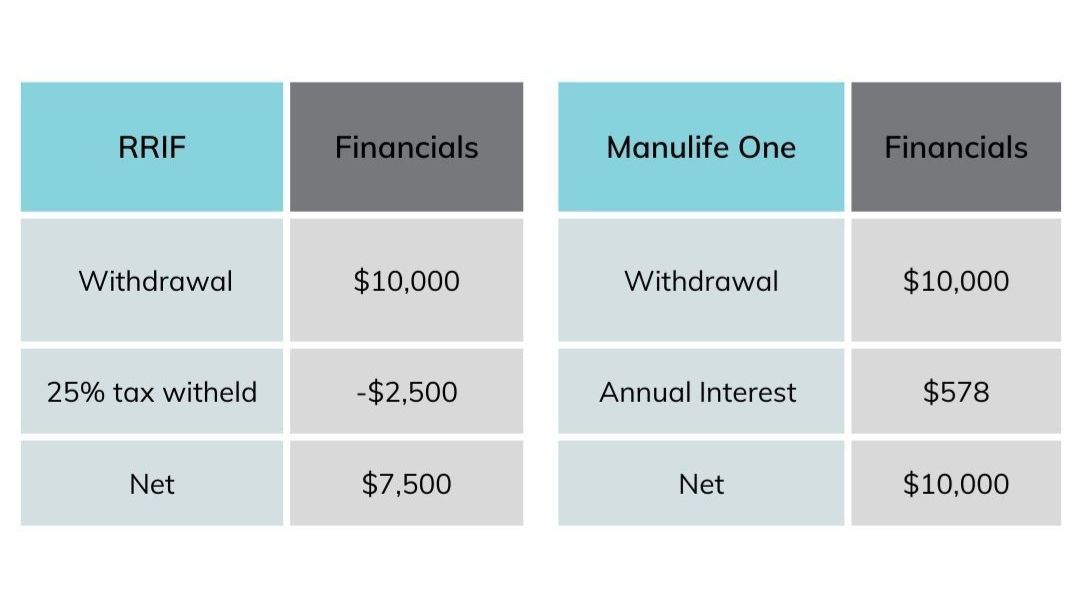

Setting You Up For Retirement

Comparing a lump sum withdrawl from a RRIF vs. Manulife One

- It would take 5 years for the interest to equal the tax implication

- Loss of return on investment

- Net cash received is higher

Manulife One can be used to supplement your retirement income or pay for larger items such as trips, home repairs, or upgrades without reducing your investment accounts.

If you are coming up for renewal now would be a great time to look at how the Manulife one could help you to achieve financial freedom faster.

Follow us on Facebook and Instagram for more mortgage tips and advice!