Mortgage Blog

The Advantages of a Reverse Mortgage

August 7, 2024 | Posted by: Sharon Patton

As we age, financial stability becomes increasingly important, and for many the home they own is their most significant asset.

Your home equity IS part of your retirement plan.

When it comes to unlocking the value of this asset, homeowners often find themselves at a crossroads: Should they opt for a reverse mortgage or sell their home and rent?

Both options have advantages and disadvantages, but understanding these can help make a more informed decision. Let's look below at the benefits of a reverse mortgage versus selling and renting.

Selling your home and renting can be a viable option, especially if maintaining a large property is becoming burdensome. Here are some benefits of this approach:

- Access to Home Equity: Selling your home provides immediate access to the full value of your home equity. This lump sum can be used to invest, travel, or simply enjoy retirement without the worry of a mortgage.

- Reduced Maintenance Responsibilities: Renting means you are not responsible for the maintenance and repairs of the property, which can be a relief for those who find home upkeep physically or financially challenging.

- Flexibility to Relocate: Renting offers the flexibility to move as needed, whether to be closer to family, to enjoy a different climate, or to explore new areas without the long-term commitment of homeownership.

A reverse mortgage is a loan that allows homeowners aged 55 and older to convert a portion of their home equity into cash. Unlike a traditional mortgage where you make monthly payments, there is no monthly payment due with a reverse mortgage.

The loan is typically repaid when the homeowner sells the home, moves out permanently, or passes away. One of the main benefits of a reverse mortgage is that it allows you to stay in your home while tapping into its equity, providing you with additional income without the need to downsize or relocate.

- Continued Homeownership: Perhaps the most significant benefit of a reverse mortgage is that it allows you to stay in your home. This is particularly advantageous for those who have strong emotional ties to their home or community and wish to maintain their current lifestyle.

- Continued Home Ownership by Downsizing: Perhaps the family home is too large now and you want to downsize. You require access to more equity than what the sale provides you. You can add a reverse mortgage to your new purchase. This allows you to maintain home ownership and have access to your equity.

- No Monthly Mortgage Payments: A reverse mortgage can be set up in several ways. You receive a lump sum or monthly payments. This flexibility allows homeowners to tailor the loan to their specific financial needs and goals. This can significantly improve your cash flow, providing additional funds for daily living expenses, medical bills, or other financial needs. The only financial responsibilities homeowners retain are property taxes, homeowners insurance, maintenance costs and utilities.

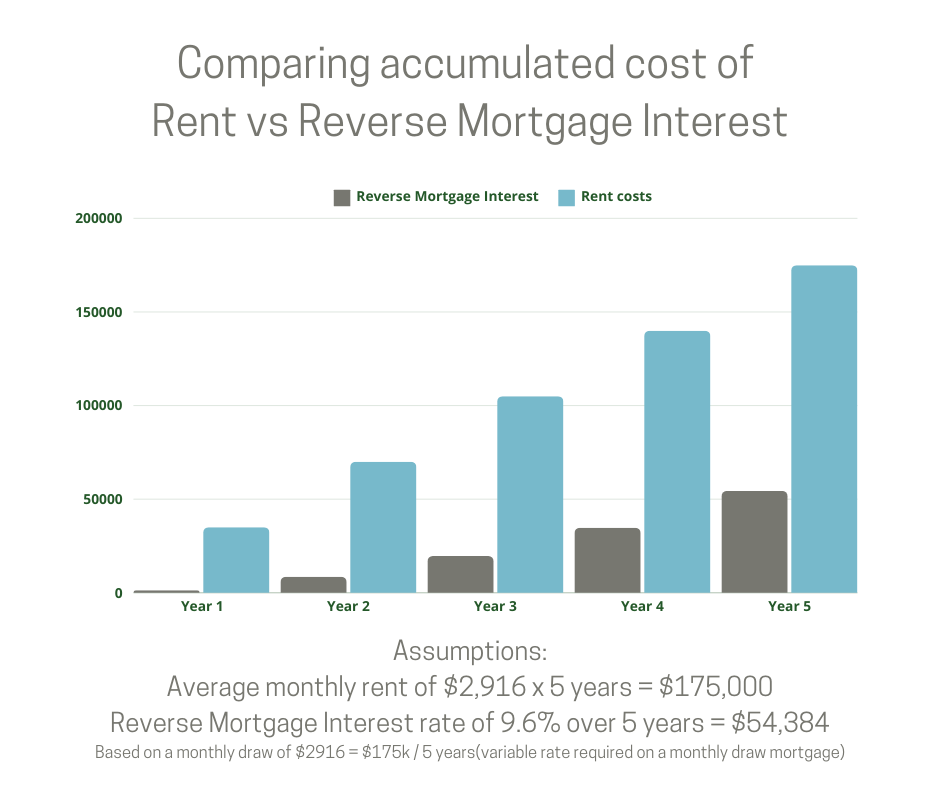

Let's take a look below at the numbers.

What does a reverse mortgage versus selling look like?

*With the reverse mortgage you will have $175,000 to spend or invest

Ultimately, the decision between a reverse mortgage and selling and renting depends on your personal circumstances, financial goals, and lifestyle preferences. A reverse mortgage may be suitable if you wish to stay in your home and need additional income without monthly payments. On the other hand, selling and renting might be better if you prefer a more flexible living arrangement and immediate access to your home equity.

Let's chat and take a look at your situation and see if the reverse mortgage is a viable option for you.

Follow us on Facebook and Instagram for mortgage tips and advice!